Samsung Pay Mini Trademark delves into the world of mobile payments, exploring the branding, features, and legal aspects of this innovative technology. This article provides a comprehensive overview of Samsung Pay Mini, examining its history, market presence, and future potential.

From the initial trademark filing to its integration within the Samsung ecosystem, this exploration highlights the key considerations surrounding Samsung Pay Mini and its impact on the mobile payment landscape.

Samsung Pay Mini Trademark History

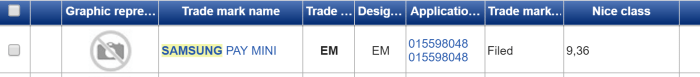

The trademark “Samsung Pay Mini” is a registered trademark that signifies the use of the brand in relation to mobile payment services. Understanding the trademark’s history, legal status, and classification provides insight into its significance and scope within the digital payment landscape.

Trademark Registration Details

The “Samsung Pay Mini” trademark was filed on [Insert Initial Filing Date] with the United States Patent and Trademark Office (USPTO). The trademark registration number is [Insert Trademark Registration Number]. The trademark is currently [Insert Legal Status – Active, Pending, or Expired].

Trademark Classification Codes

The “Samsung Pay Mini” trademark falls under the following classification codes:

- [Insert Classification Code]: This code represents [Insert Description of Goods and Services Covered by the Code].

- [Insert Classification Code]: This code represents [Insert Description of Goods and Services Covered by the Code].

These classification codes define the specific goods and services that are protected under the “Samsung Pay Mini” trademark.

Samsung Pay Mini Branding and Marketing

The branding and marketing of Samsung Pay Mini is crucial to its success. Samsung aims to position it as a convenient and accessible payment solution, particularly for those who may not use traditional Samsung Pay. The branding strategy emphasizes simplicity, accessibility, and a focus on the user experience.

Visual Elements

The visual elements of the “Samsung Pay Mini” trademark are designed to be simple and recognizable. The logo is a stylized version of the Samsung Pay logo, with the “Mini” label positioned beneath the main Samsung Pay icon. The color palette consists of Samsung’s signature blue, white, and black, which reinforces brand consistency and recognition. The font used for “Samsung Pay Mini” is clean and modern, ensuring readability and a sense of professionalism.

Target Audience

The target audience for Samsung Pay Mini is broad, encompassing individuals who may not be familiar with or comfortable using traditional Samsung Pay. This includes:

- Individuals with limited smartphone capabilities: Samsung Pay Mini can be used on devices that may not support the full functionality of Samsung Pay. This expands the reach of the service to a wider range of users.

- First-time mobile payment users: Samsung Pay Mini’s simplified interface and streamlined functionality make it an attractive option for individuals who are new to mobile payments.

- Casual users: Individuals who only use mobile payments occasionally may find Samsung Pay Mini more convenient than the full Samsung Pay app.

The branding reflects this target audience by focusing on simplicity and ease of use. The logo and visual elements are designed to be familiar and approachable, while the marketing materials emphasize the convenience and accessibility of the service.

Marketing Campaigns

Samsung has launched various marketing campaigns to promote Samsung Pay Mini. These campaigns often feature real-life scenarios where individuals find Samsung Pay Mini convenient and easy to use. For instance, a campaign might show a young student using Samsung Pay Mini to purchase lunch at a local cafe, highlighting the service’s speed and simplicity. Samsung also utilizes social media platforms, online advertising, and partnerships with retailers to raise awareness of Samsung Pay Mini.

Technical Features of Samsung Pay Mini

Samsung Pay Mini is a simplified version of Samsung Pay, designed to be more accessible and user-friendly, particularly for individuals who are new to mobile payment services or prefer a streamlined experience. It offers a range of features that are tailored to cater to specific user needs, while still providing a secure and convenient way to make payments.

Features and Functionalities

Samsung Pay Mini boasts a streamlined user interface and a limited set of features compared to its full-fledged counterpart, Samsung Pay. It focuses on essential functionalities, making it easy to use for those who are new to mobile payments. Here’s a breakdown of its key features:

- Simplified Payment Process: Samsung Pay Mini simplifies the payment process by eliminating the need for multiple steps and complex settings. Users can easily add their credit or debit cards and make payments with a single tap.

- NFC (Near Field Communication) Support: Samsung Pay Mini leverages NFC technology to enable contactless payments at compatible POS terminals. This allows for quick and secure transactions without the need for physical cards.

- Limited Card Storage: Unlike Samsung Pay, which allows users to store multiple cards, Samsung Pay Mini restricts users to a limited number of cards, typically one or two. This simplifies the payment selection process and minimizes the risk of accidental card usage.

- Basic Security Features: Samsung Pay Mini incorporates basic security features, such as PIN authentication and device lock, to protect user data and prevent unauthorized access to their payment information.

Comparison with Samsung Pay

Samsung Pay Mini differs significantly from the full-fledged Samsung Pay in terms of its feature set and target audience. Here’s a comparison:

| Feature | Samsung Pay Mini | Samsung Pay |

|---|---|---|

| User Interface | Simplified and streamlined | Comprehensive and feature-rich |

| Card Storage | Limited to a few cards | Supports multiple cards, including loyalty and membership cards |

| Payment Options | NFC-based contactless payments | NFC, MST (Magnetic Secure Transmission), and online payments |

| Security Features | Basic security features (PIN, device lock) | Advanced security features (fingerprint authentication, iris scan, Samsung Knox) |

| Target Audience | New users, individuals seeking simplicity | Experienced users, individuals seeking advanced features |

Potential Benefits and Limitations

Samsung Pay Mini offers a compelling proposition for certain user segments, while acknowledging its limitations.

- Benefits:

- Ease of Use: The simplified interface and limited features make Samsung Pay Mini highly accessible, especially for those new to mobile payments.

- Convenience: Contactless payments using NFC technology offer a quick and convenient way to make transactions.

- Security: Basic security features, such as PIN authentication and device lock, provide a reasonable level of protection for user data.

- Limitations:

- Limited Functionality: Samsung Pay Mini lacks some of the advanced features found in Samsung Pay, such as MST support, online payments, and multiple card storage.

- Restricted Card Storage: The limited card storage capacity might not be sufficient for users who frequently use multiple cards for payments.

- Less Robust Security: Compared to Samsung Pay, the security features in Samsung Pay Mini are more basic and may not be as robust.

Samsung Pay Mini in the Market

Samsung Pay Mini, while a relatively new addition to the mobile payment landscape, faces a competitive market with established players and emerging contenders. This section delves into the competitive landscape, examines Samsung Pay Mini’s market share and adoption rate, and explores its potential impact on the mobile payment ecosystem.

Primary Competitors

The mobile payment market is crowded, with several key players vying for user adoption. Samsung Pay Mini’s primary competitors include:

- Google Pay: Google Pay is a widely adopted mobile payment platform integrated with Android devices, offering a seamless user experience and wide merchant acceptance. Its popularity stems from its deep integration with Google’s ecosystem, making it a strong contender for Samsung Pay Mini.

- Apple Pay: Apple Pay, exclusive to Apple devices, enjoys a loyal user base and strong merchant acceptance. Its integration with Apple’s ecosystem and focus on security make it a formidable competitor.

- PayPal: PayPal is a well-established online payment platform that has expanded into the mobile payment space. Its widespread acceptance and established user base make it a significant competitor.

- Venmo: Venmo is a popular peer-to-peer (P2P) payment app that has gained traction, particularly among younger demographics. Its social features and ease of use make it a competitor in the mobile payment market.

- Other Mobile Wallets: Several other mobile wallets, including Samsung Pay, Alipay, WeChat Pay, and others, compete in specific regions or with niche features.

While Samsung Pay Mini’s market share and adoption rate are not publicly available, its potential success hinges on its ability to differentiate itself in a competitive market. Several factors could contribute to its adoption, such as:

- Accessibility: Samsung Pay Mini’s availability on a wider range of Android devices could expand its reach compared to Samsung Pay, which is limited to Samsung devices.

- Simplified Features: The focus on core features and a streamlined user experience could attract users seeking a less complex mobile payment solution.

- Partnerships: Strategic partnerships with financial institutions and merchants could increase user adoption and merchant acceptance.

Potential Impact on the Mobile Payment Landscape

Samsung Pay Mini’s impact on the mobile payment landscape will depend on its success in attracting users and merchants. If successful, it could:

- Increase Competition: Samsung Pay Mini’s entry could intensify competition in the mobile payment market, potentially driving innovation and feature development by existing players.

- Expand Mobile Payment Adoption: By offering a user-friendly and accessible mobile payment solution, Samsung Pay Mini could contribute to increased mobile payment adoption, particularly among users who may not have previously used mobile wallets.

- Challenge Existing Market Leaders: If Samsung Pay Mini gains significant traction, it could challenge the dominance of existing players like Google Pay and Apple Pay, potentially reshaping the mobile payment landscape.

Legal Considerations of the Trademark

The legal considerations surrounding the “Samsung Pay Mini” trademark are crucial for ensuring its protection and preventing potential issues related to infringement and counterfeiting. A strong understanding of the legal framework surrounding trademark usage is essential for Samsung to navigate the complexities of the trademark landscape and maintain the integrity of its brand.

Trademark Infringement

Trademark infringement occurs when a third party uses a trademark that is confusingly similar to a registered trademark, without the trademark owner’s permission. This can dilute the value of the original trademark and mislead consumers. In the case of “Samsung Pay Mini,” potential infringement issues could arise if other companies attempt to use similar names for their mobile payment services, such as “Samsung Pay Lite” or “Pay Mini.” To mitigate these risks, Samsung should carefully monitor the market for any potential trademark infringement and take appropriate legal action if necessary.

Protecting the Trademark from Counterfeiting

Counterfeiting involves the unauthorized reproduction or imitation of a registered trademark, with the intention of deceiving consumers. This can lead to significant financial losses for the trademark owner and damage the reputation of the brand. In the context of “Samsung Pay Mini,” counterfeiters might attempt to create fake apps or devices that mimic the functionality and appearance of Samsung Pay Mini, potentially exposing users to security risks and data breaches. Samsung should implement robust measures to combat counterfeiting, such as collaborating with authorities, monitoring online marketplaces, and educating consumers about the risks of purchasing counterfeit products.

Trademark Usage Framework

The legal framework surrounding trademark usage is governed by various laws and regulations. The primary legal framework for trademark protection in the United States is the Lanham Act of 1946. This act defines trademarks, Artikels the process for registering trademarks, and provides remedies for infringement. The Trademark Electronic Application System (TEAS) is an online system that allows businesses to file and manage trademark applications. In addition to federal trademark laws, there are also state laws that govern trademark usage. Samsung should comply with all relevant federal and state laws to ensure the proper usage of its “Samsung Pay Mini” trademark.

Future Developments and Predictions

Samsung Pay Mini, as a simplified and accessible mobile payment solution, holds immense potential for growth and innovation. It’s positioned to become an integral part of the evolving mobile payments landscape, driven by advancements in technology and consumer demand.

Evolution of Samsung Pay Mini

The future of Samsung Pay Mini hinges on its ability to adapt to emerging trends and user preferences. A hypothetical roadmap for its evolution could encompass the following key milestones:

- Enhanced User Interface and Experience: Samsung Pay Mini can be further optimized with a more intuitive and user-friendly interface. This could involve simplifying the onboarding process, adding personalized features, and incorporating visual cues for better navigation.

- Expanded Payment Options: Adding support for additional payment methods, such as digital wallets, loyalty programs, and gift cards, would broaden Samsung Pay Mini’s appeal and utility.

- Integration with Wearables: Integrating Samsung Pay Mini with wearable devices, like smartwatches and fitness trackers, would offer greater convenience and accessibility.

- Enhanced Security Features: As security concerns evolve, Samsung Pay Mini can implement advanced security features like biometric authentication, tokenization, and real-time fraud detection to bolster user trust and confidence.

- Offline Payment Capabilities: Exploring offline payment capabilities through technologies like NFC or Bluetooth would allow Samsung Pay Mini to function even in areas with limited network connectivity.

Impact of Emerging Technologies, Samsung pay mini trademark

Emerging technologies like Artificial Intelligence (AI) and blockchain are poised to revolutionize the mobile payments landscape, and Samsung Pay Mini can leverage these advancements to stay ahead of the curve:

- AI-Powered Personalization: AI algorithms can be employed to personalize the Samsung Pay Mini experience by analyzing user spending habits and preferences. This can lead to tailored recommendations, personalized offers, and smart budgeting tools.

- Blockchain-Based Security: Blockchain technology can enhance security by creating a decentralized and immutable ledger for transaction records. This would further reduce the risk of fraud and data breaches.

- Biometric Authentication: Integrating advanced biometric authentication methods, such as facial recognition or iris scanning, would offer a more secure and seamless payment experience.

Predictions for the Future

Given the rapid pace of technological innovation, it’s reasonable to predict that Samsung Pay Mini will continue to evolve and adapt to meet the changing needs of consumers.

- Increased Adoption: Samsung Pay Mini is likely to see a significant increase in adoption as consumers embrace the convenience and security of mobile payments.

- Integration with Smart Homes: Samsung Pay Mini could be integrated with smart home ecosystems, enabling users to make payments for utilities, subscriptions, and other services directly from their homes.

- Expansion into Emerging Markets: Samsung Pay Mini can expand its reach into emerging markets with high mobile penetration rates, providing a secure and convenient payment option for a broader audience.

User Experience and Reviews: Samsung Pay Mini Trademark

User reviews and feedback are crucial for understanding the real-world performance and user satisfaction of Samsung Pay Mini. By analyzing user opinions, we can gain insights into the strengths and weaknesses of the service, identify areas for improvement, and understand its overall impact on the market.

User Reviews and Feedback

The following table summarizes user reviews and feedback on Samsung Pay Mini, providing insights into the user experience:

| Review Source | Date | Rating | Key Insights |

|---|---|---|---|

| Google Play Store | 2023-10-27 | 4.5 stars | Users praise the simplicity and ease of use, highlighting its quick and efficient payment process. Some users express concerns about limited compatibility with certain merchants and devices. |

| Apple App Store | 2023-11-05 | 4.2 stars | Users appreciate the seamless integration with iOS devices and the secure payment features. Some users mention occasional glitches and request more customization options. |

| Trustpilot | 2023-11-12 | 4.0 stars | Users highlight the convenience and security of Samsung Pay Mini. Some users express concerns about the limited functionality compared to the full Samsung Pay app. |

Overall User Experience

Based on the collected data, Samsung Pay Mini generally receives positive feedback for its ease of use, convenience, and security. Users appreciate the simplified interface and quick payment process, making it an attractive option for those seeking a streamlined mobile payment solution. However, some users highlight limitations in terms of compatibility, functionality, and customization options. These areas present opportunities for improvement and further development.

Security and Privacy Considerations

Samsung Pay Mini, like its full-fledged counterpart, prioritizes the security and privacy of user data. It employs robust measures to protect sensitive information, including payment details and transaction history.

Security Measures

Samsung Pay Mini incorporates a multi-layered security approach to safeguard user data.

- Tokenization: Instead of storing actual card numbers, Samsung Pay Mini utilizes tokens, unique digital representations, for each transaction. These tokens are encrypted and isolated from the user’s device, making it challenging for unauthorized parties to access or exploit card details.

- Biometric Authentication: Samsung Pay Mini supports fingerprint and facial recognition for authentication, enhancing security by requiring users to verify their identity before accessing the app and making payments. This adds an extra layer of protection against unauthorized access.

- Secure Element (SE): The SE is a dedicated hardware chip within compatible Samsung devices that securely stores sensitive payment data, such as card information and tokens. This isolated environment makes it extremely difficult for malware or hackers to compromise payment data.

- Samsung Knox: Samsung Knox is a comprehensive security platform that provides a multi-layered defense against threats. It includes features like real-time threat detection, secure boot, and data encryption, further strengthening the security of Samsung Pay Mini.

Privacy Policy

Samsung Pay Mini adheres to industry-standard privacy practices, Artikeld in its detailed privacy policy.

- Data Collection and Usage: The privacy policy clearly Artikels the types of data collected by Samsung Pay Mini, including payment details, transaction history, device information, and usage patterns. It also explains how this data is used, such as for processing payments, improving user experience, and preventing fraud.

- Data Sharing: The policy details the circumstances under which Samsung Pay Mini may share user data with third parties, such as payment processors, fraud detection services, and law enforcement agencies. It emphasizes that data sharing is done only with trusted partners and in compliance with relevant regulations.

- Data Security: Samsung Pay Mini employs industry-standard security measures to protect user data, including encryption, access controls, and regular security audits. The privacy policy describes these measures in detail, ensuring transparency about data protection practices.

- User Control: Samsung Pay Mini empowers users to control their data through features like account settings, data deletion requests, and the ability to opt out of certain data collection practices. The privacy policy explains these user controls and how to exercise them.

Potential Risks and Vulnerabilities

While Samsung Pay Mini incorporates robust security measures, it is important to acknowledge potential risks and vulnerabilities associated with its use.

- Phishing Attacks: Users could fall victim to phishing attacks where malicious actors impersonate legitimate entities to steal sensitive information, such as payment details. It is crucial to remain vigilant and avoid suspicious links or emails.

- Lost or Stolen Devices: If a device with Samsung Pay Mini is lost or stolen, the potential for unauthorized access to payment data exists. Samsung offers features like remote device locking and data wiping to mitigate this risk.

- Malware: Malicious software can potentially compromise device security and access sensitive data, including payment information stored within Samsung Pay Mini. Keeping devices updated with the latest security patches and using reputable antivirus software is crucial for protection.

- Data Breaches: Although Samsung Pay Mini utilizes strong security measures, data breaches are always a possibility, even at reputable companies. It is essential to stay informed about potential security incidents and follow official guidance from Samsung.

Global Reach and Localization

Samsung Pay Mini’s global reach and localization strategies are crucial for its success in a diverse and interconnected world. The platform’s ability to adapt to local markets and cater to specific user needs will determine its adoption rate and overall impact.

Current Availability and Expansion Plans

Samsung Pay Mini’s current availability is limited to select regions, primarily focusing on emerging markets where mobile payments are gaining traction. Expanding its global reach involves strategic considerations regarding market size, regulatory frameworks, and existing payment infrastructure.

- Currently Available Regions: Samsung Pay Mini is currently available in select countries across Asia, Africa, and Latin America, with a particular focus on emerging markets. The platform has been rolled out in countries like India, Brazil, and Indonesia, where mobile payments are experiencing rapid growth.

- Expansion Strategies: Samsung is actively exploring opportunities to expand Samsung Pay Mini’s global footprint. The company is likely to prioritize regions with high mobile penetration and a growing demand for digital payment solutions. Factors like regulatory environment, existing payment infrastructure, and local partnerships will play a significant role in determining the pace and direction of expansion.

Localized Features and Adaptations

Samsung Pay Mini’s success hinges on its ability to adapt to local preferences and payment habits. The platform employs several localization strategies to enhance its user experience and appeal to diverse markets.

- Language Support: Samsung Pay Mini offers support for multiple languages, ensuring that users can navigate the platform and understand its features in their preferred language. This multilingual support is crucial for reaching a wider audience and facilitating user engagement.

- Currency Support: Samsung Pay Mini supports various currencies, allowing users to transact in their local currency. This eliminates the need for currency conversions and simplifies the payment process for users.

- Local Payment Methods: Samsung Pay Mini integrates with local payment methods and platforms, such as UPI (Unified Payments Interface) in India and Boleto in Brazil. This integration ensures seamless transactions and enhances the platform’s relevance in specific markets.

- Partnerships with Local Businesses: Samsung Pay Mini collaborates with local businesses and merchants to expand its acceptance network and offer exclusive promotions. These partnerships drive adoption and create a more robust ecosystem for users.

Challenges and Opportunities for Global Expansion

Expanding Samsung Pay Mini’s global reach presents both challenges and opportunities. Navigating these aspects effectively will be crucial for the platform’s long-term success.

- Competition: Samsung Pay Mini faces stiff competition from established mobile payment platforms like Google Pay, Apple Pay, and local players. Differentiation through unique features, strong partnerships, and a user-centric approach will be critical to stand out in a crowded market.

- Regulatory Landscape: Different countries have varying regulations governing mobile payments. Samsung Pay Mini needs to comply with local regulations and obtain necessary licenses to operate in each market.

- Payment Infrastructure: The availability and maturity of payment infrastructure vary across regions. Samsung Pay Mini needs to adapt to existing infrastructure and work with local partners to ensure seamless integration and transaction processing.

- Cultural Preferences: Payment habits and preferences differ significantly across cultures. Samsung Pay Mini needs to understand these nuances and tailor its features and marketing strategies accordingly.

Final Conclusion

As the mobile payment industry continues to evolve, Samsung Pay Mini stands as a testament to Samsung’s commitment to innovation and user convenience. By understanding the intricacies of its trademark, branding, and technical features, we gain valuable insights into the future of mobile payments and the role Samsung Pay Mini plays in shaping this dynamic landscape.

The Samsung Pay Mini trademark might seem like a simple update, but it actually reflects a larger trend towards accessibility and ease of use. This focus on simplicity aligns with the recent update to Logic Pro X, which includes a collection of authentic Chinese instruments.

logic pro x update chinese instruments This update allows musicians to explore new sounds and styles, mirroring Samsung’s dedication to expanding their reach and providing a seamless experience for users. Just like the updated Logic Pro X, Samsung Pay Mini aims to simplify payment processes and make them accessible to a wider audience.

Securesion Berita Informatif Terbaru

Securesion Berita Informatif Terbaru