Nvidia AMD Market Share Study: A Deep Dive into the GPU Industry delves into the intense rivalry between two giants, exploring their historical dominance, current market positions, and future prospects. This study analyzes the key factors driving their success, including technological innovation, product portfolios, strategic partnerships, and market trends.

The GPU market is a dynamic and rapidly evolving landscape, with Nvidia and AMD constantly vying for market share. This study examines the competitive landscape, analyzes the strengths and weaknesses of each company, and provides insights into the factors that will shape the future of the industry.

The past decade has witnessed a dynamic evolution in the market share landscape of Nvidia and AMD, two leading players in the semiconductor industry. This section explores the historical trends in their market share, highlighting key milestones and events that shaped their competitive landscape.

The gaming GPU market is the primary battleground for Nvidia and AMD. The following timeline Artikels the significant changes in their market share:

- 2012-2014: Nvidia held a dominant position with a market share exceeding 70%, while AMD struggled to gain traction. This period saw Nvidia’s GeForce GTX 600 and 700 series GPUs enjoy widespread adoption, thanks to their performance and marketing efforts.

- 2015-2017: AMD launched its Radeon RX 400 and 500 series GPUs, introducing competitive pricing and performance, which started to chip away at Nvidia’s dominance. This period also saw the rise of cryptocurrency mining, boosting demand for high-end GPUs, benefiting both companies.

- 2018-2020: Nvidia solidified its lead again with the release of its Turing architecture-based GeForce RTX 20 series GPUs, introducing real-time ray tracing capabilities. AMD countered with its Navi architecture-based Radeon RX 5000 series, delivering better price-to-performance ratios.

- 2021-Present: Both companies released their latest generation of GPUs, the GeForce RTX 30 series and Radeon RX 6000 series, respectively. While Nvidia continues to lead in market share, AMD has narrowed the gap, particularly in the high-end segment. This period has been marked by ongoing supply chain constraints and increased demand for GPUs, driven by gaming, cryptocurrency mining, and the rise of cloud gaming.

The data center GPU market is a relatively new but rapidly growing segment for both Nvidia and AMD. Nvidia has been a dominant player in this market, primarily due to its CUDA platform and its early adoption by companies like Tesla and Google.

- 2012-2016: Nvidia dominated the data center GPU market with its Tesla GPUs, catering to high-performance computing (HPC), artificial intelligence (AI), and machine learning (ML) workloads. AMD’s presence was limited in this segment.

- 2017-2020: AMD made significant strides in the data center market with its Radeon Instinct GPUs, focusing on AI and ML workloads. The company’s competitive pricing and energy efficiency attracted customers looking for alternatives to Nvidia’s solutions.

- 2021-Present: Nvidia continues to lead the data center GPU market, but AMD is gaining momentum with its MI200 series GPUs, designed for AI and HPC workloads. The rise of cloud computing and the increasing adoption of AI are driving growth in this segment, benefiting both companies.

The automotive GPU market is a relatively new and rapidly evolving segment. Nvidia has established a strong presence in this market, supplying its GPUs for advanced driver-assistance systems (ADAS) and infotainment systems.

- 2012-2016: Nvidia entered the automotive GPU market with its Drive platform, providing GPUs for ADAS and infotainment systems. AMD’s presence in this segment was minimal.

- 2017-2020: AMD expanded its presence in the automotive GPU market with its Radeon RX Vega GPUs, targeting infotainment and ADAS applications. The company’s focus on power efficiency and cost-effectiveness attracted some automotive manufacturers.

- 2021-Present: Nvidia continues to dominate the automotive GPU market, with its Drive platform powering ADAS and autonomous driving systems in leading car manufacturers. AMD is also expanding its presence, targeting specific segments with its Radeon RX 6000 series GPUs. The increasing adoption of ADAS and autonomous driving technologies is driving growth in this segment.

The current market share landscape for Nvidia and AMD is a dynamic one, with both companies vying for dominance in various segments. This section delves into the current market share distribution, analyzing the contributing factors and comparing the strengths and weaknesses of each company’s product offerings.

The current market share distribution for Nvidia and AMD varies significantly across different segments.

- Graphics Processing Units (GPUs): Nvidia holds a dominant position in the high-end gaming GPU market, capturing over 70% of the market share. AMD, however, has made significant inroads in the mid-range and budget segments, capturing a substantial share with its Radeon RX series.

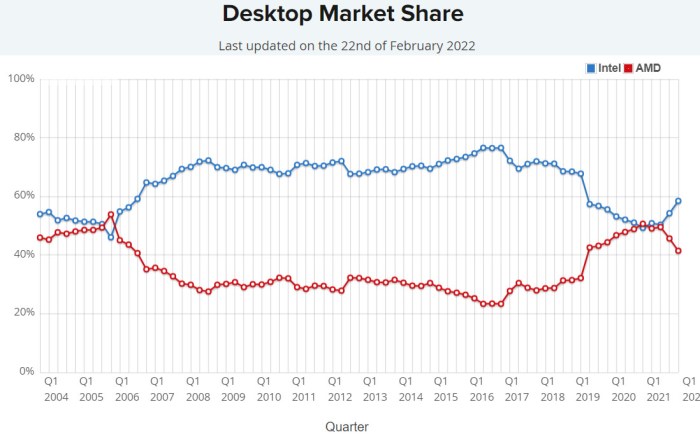

- Central Processing Units (CPUs): AMD has made significant gains in the CPU market, challenging Intel’s long-standing dominance. AMD’s Ryzen series CPUs have become popular for their performance and price, leading to a market share of around 40%.

- Data Center Processors: Nvidia has a strong presence in the data center market, with its GPUs being widely used for AI and machine learning applications. However, AMD is also gaining ground in this segment, with its EPYC processors finding adoption in cloud computing and high-performance computing applications.

Several factors contribute to the current market share positions of Nvidia and AMD.

- Product Performance: Both companies invest heavily in research and development to deliver high-performance products. Nvidia’s GPUs are known for their superior gaming performance, while AMD’s Ryzen CPUs offer competitive performance at lower prices.

- Product Portfolio: Nvidia has a wide range of products, catering to different market segments. AMD, however, has focused on offering competitive products in specific segments, such as gaming and data centers.

- Marketing and Branding: Nvidia has established a strong brand image, particularly in the gaming community. AMD, on the other hand, has been actively promoting its Ryzen CPUs and Radeon GPUs, aiming to increase brand awareness and market share.

- Pricing Strategy: Nvidia’s pricing strategy has been criticized for being high, particularly for its high-end GPUs. AMD, however, has adopted a more competitive pricing strategy, offering high-performance products at lower prices.

Product Offerings Comparison

While both Nvidia and AMD offer competitive products, their strengths and weaknesses differ.

- Nvidia Strengths:

- Superior gaming performance in high-end GPUs.

- Strong presence in the data center market with GPUs for AI and machine learning.

- Strong brand image and marketing efforts.

- Nvidia Weaknesses:

- High pricing strategy for high-end GPUs.

- Limited product offerings in the mid-range and budget GPU segments.

- AMD Strengths:

- Competitive performance and pricing for Ryzen CPUs.

- Strong presence in the mid-range and budget GPU segments.

- Increasing market share in the data center market with EPYC processors.

- AMD Weaknesses:

- Limited market share in the high-end GPU segment.

- Brand image not as strong as Nvidia.

The GPU market is fiercely competitive, with Nvidia and AMD vying for dominance in various segments. Understanding the competitive landscape is crucial for evaluating the strategies of both companies and predicting future market trends.

Key Competitors in Each Segment

The competitive landscape for Nvidia and AMD varies significantly across different market segments.

- Gaming: In the gaming segment, Nvidia and AMD face competition from Intel, which has recently entered the discrete GPU market with its Arc series. Other players include smaller companies like ASRock, MSI, and Gigabyte, which primarily focus on manufacturing graphics cards based on Nvidia and AMD chips.

- Data Center: In the data center segment, Nvidia and AMD compete with Intel, which is a dominant player in the CPU market. Both companies also face competition from specialized AI chip companies like Google’s TPU and Graphcore’s IPUs. Nvidia and AMD are also increasingly competing with cloud providers like AWS and Google Cloud, which offer their own custom-designed chips for specific workloads.

- Professional Workstation: In the professional workstation segment, Nvidia and AMD compete with Intel and companies specializing in specific applications, such as Autodesk and Adobe. The focus in this segment is on high-performance computing and specialized software support.

Competitive Strategies

Both Nvidia and AMD employ a variety of strategies to maintain or gain market share.

- Product Innovation: Both companies invest heavily in research and development to create new and innovative products. Nvidia has focused on features like ray tracing and DLSS, while AMD has emphasized performance and value. Both companies are constantly pushing the boundaries of GPU technology, introducing new architectures and features to attract consumers.

- Pricing and Value: Nvidia often positions its products at a premium price point, emphasizing features and performance. AMD, on the other hand, has historically focused on offering competitive performance at lower price points. This strategy has allowed AMD to gain significant market share in recent years, particularly in the gaming segment.

- Partnerships and Ecosystem: Both companies have built strong ecosystems of partners, including motherboard manufacturers, software developers, and system integrators. These partnerships are crucial for ensuring that their products are compatible and optimized for various applications. Nvidia’s GeForce Now cloud gaming service and AMD’s FidelityFX suite of graphics technologies are examples of initiatives aimed at expanding their ecosystems.

- Marketing and Branding: Nvidia has successfully established a strong brand identity through its marketing efforts. AMD, on the other hand, has been working to re-establish its brand image and promote its products more effectively. Both companies use various marketing channels, including online advertising, social media, and partnerships with influencers, to reach their target audiences.

Regional Competitive Landscape

The competitive landscape for Nvidia and AMD can vary significantly across different regions.

- Asia: In Asia, particularly in China, AMD has gained significant market share in recent years. This is due to several factors, including the popularity of AMD’s Ryzen CPUs and the growing demand for gaming PCs in the region. Nvidia still holds a strong position in Asia, but AMD’s increasing market share presents a challenge.

- North America: In North America, Nvidia continues to dominate the GPU market, particularly in the high-end gaming segment. AMD has made significant inroads in recent years, but Nvidia still holds a substantial market share. The competition in North America is fierce, with both companies aggressively competing for market share.

- Europe: In Europe, the competitive landscape is similar to North America, with Nvidia holding a strong position. However, AMD has made progress in gaining market share in recent years, particularly in the gaming segment. The European market is important for both companies, as it represents a significant portion of global GPU sales.

Market Drivers and Trends

The GPU market is driven by a complex interplay of factors, including technological advancements, emerging applications, and shifting consumer preferences. These drivers influence the market share dynamics of Nvidia and AMD, shaping their competitive landscape and future prospects.

Technological Advancements

Technological advancements are a primary driver of the GPU market. The relentless pursuit of higher performance, efficiency, and new features fuels innovation and drives demand for advanced GPUs.

- Increased Processing Power: Advancements in semiconductor technology, such as smaller transistors and improved architectures, enable GPUs to deliver significantly higher processing power, leading to enhanced gaming experiences, faster AI training, and improved scientific simulations.

- Artificial Intelligence (AI) and Machine Learning (ML): The rise of AI and ML has spurred demand for specialized GPUs with high parallel processing capabilities, as these tasks require massive computational power. Nvidia’s CUDA platform and AMD’s ROCm platform have become essential for AI and ML development.

- Ray Tracing and Real-Time Rendering: Ray tracing is a rendering technique that simulates the path of light in a scene, creating more realistic and immersive visuals. GPUs with dedicated ray tracing cores are becoming increasingly popular, particularly in gaming and content creation.

Emerging Applications

The emergence of new applications is expanding the GPU market and creating new opportunities for Nvidia and AMD.

- Cloud Gaming: Cloud gaming services, such as GeForce NOW and Xbox Cloud Gaming, allow users to stream games to various devices, reducing the need for high-end hardware. This trend is driving demand for powerful cloud-based GPUs.

- Metaverse and Virtual Reality (VR): The development of the metaverse and VR experiences requires GPUs with high processing power and real-time rendering capabilities. Nvidia and AMD are both investing heavily in these technologies, aiming to capture a share of this growing market.

- Cryptocurrency Mining: While the cryptocurrency market has experienced volatility, GPUs have historically been used for mining cryptocurrencies like Bitcoin and Ethereum. This application has driven demand for GPUs, particularly those with high hash rates.

Consumer Preferences

Consumer preferences play a significant role in shaping the GPU market.

- Gaming Performance: Gamers prioritize high frame rates, smooth gameplay, and realistic visuals. GPUs with high performance and advanced features, such as ray tracing, are highly sought after.

- Value for Money: Consumers are increasingly price-conscious, looking for GPUs that offer the best performance at a reasonable price. This has led to competition among GPU manufacturers to provide affordable options.

- Energy Efficiency: Concerns about energy consumption and environmental impact are driving demand for energy-efficient GPUs. Both Nvidia and AMD are focusing on reducing power consumption without sacrificing performance.

Product Portfolio Analysis

This section delves into the product portfolios of Nvidia and AMD, examining their key product lines, features, performance, capabilities, and target markets. By analyzing the product portfolios of both companies, we gain valuable insights into their competitive strengths and strategies.

Nvidia’s Product Portfolio

Nvidia’s product portfolio encompasses a wide range of products, primarily focused on graphics processing units (GPUs) and system-on-a-chip (SoC) solutions.

Nvidia’s GPUs are renowned for their performance and are widely used in gaming, professional graphics, artificial intelligence (AI), and high-performance computing (HPC). Nvidia’s GeForce GPUs are targeted at gamers, while the Quadro and Tesla lines cater to professional graphics and AI applications.

Nvidia’s SoC solutions, including the Tegra line, are designed for mobile devices, automotive, and other embedded systems.

AMD’s Product Portfolio

AMD’s product portfolio also encompasses a wide range of products, including CPUs, GPUs, and chipsets. AMD’s CPUs are known for their competitive performance and price, targeting both desktop and server markets.

AMD’s GPUs, under the Radeon brand, are primarily used in gaming, professional graphics, and HPC.

AMD’s chipsets are used in motherboards for both CPUs and GPUs.

Comparison of Nvidia and AMD Products

- Performance: Nvidia GPUs generally offer higher performance in gaming and professional graphics applications. However, AMD GPUs have gained significant ground in recent years, offering competitive performance at lower price points.

- Features: Both companies offer a wide range of features in their products, including ray tracing, AI acceleration, and advanced display technologies. Nvidia’s DLSS (Deep Learning Super Sampling) technology and AMD’s FidelityFX Super Resolution (FSR) are prominent examples of AI-powered upscaling features.

- Target Markets: Nvidia’s GPUs are popular among gamers and professionals seeking high-performance solutions. AMD’s GPUs are more competitive in the mid-range and entry-level markets, attracting a wider range of users.

Nvidia’s Key Product Lines

Nvidia’s key product lines include:

- GeForce: Nvidia’s GeForce GPUs are designed for gamers, offering high performance and advanced features.

- Quadro: Nvidia’s Quadro GPUs are targeted at professional graphics applications, such as CAD, video editing, and rendering.

- Tesla: Nvidia’s Tesla GPUs are designed for high-performance computing, AI, and data science applications.

- Tegra: Nvidia’s Tegra SoCs are used in mobile devices, automotive, and other embedded systems.

AMD’s Key Product Lines

AMD’s key product lines include:

- Ryzen: AMD’s Ryzen CPUs are designed for both desktop and server markets, offering competitive performance and price.

- Radeon: AMD’s Radeon GPUs are used in gaming, professional graphics, and HPC applications.

- Xilinx: AMD acquired Xilinx in 2022, adding FPGAs (Field-Programmable Gate Arrays) to its portfolio. FPGAs are highly customizable chips used in various applications, including AI, networking, and industrial automation.

Product Portfolio Analysis: Key Observations

- Nvidia: Nvidia’s focus on high-performance GPUs has solidified its dominance in gaming and professional graphics. Nvidia’s extensive research and development efforts have resulted in innovative technologies, such as ray tracing and DLSS, enhancing the user experience.

- AMD: AMD has been aggressively competing with Nvidia in the GPU market, offering competitive performance at lower prices. AMD’s Ryzen CPUs have also gained significant market share, particularly in the desktop and server markets.

Financial Performance Analysis

Nvidia and AMD, the leading players in the graphics processing unit (GPU) market, have witnessed significant financial performance over the past few years, driven by the growing demand for high-performance computing in various applications, including gaming, data centers, and artificial intelligence (AI). This section delves into the financial performance of both companies, analyzing key financial metrics to understand their financial health and growth potential.

Financial Performance Comparison

Nvidia and AMD have both achieved remarkable financial growth in recent years, driven by strong demand for their GPUs in various applications.

- Nvidia’s revenue has consistently grown at a faster pace than AMD’s, driven by its dominance in the gaming GPU market and its strong position in the data center and AI markets. For instance, in 2022, Nvidia’s revenue reached $26.9 billion, compared to AMD’s revenue of $16.4 billion.

- However, AMD has shown a more significant improvement in its profitability, with its gross margin consistently increasing in recent years, exceeding Nvidia’s gross margin in 2022. This improvement can be attributed to AMD’s focus on optimizing its manufacturing processes and its ability to compete effectively in the high-performance computing market.

Key Financial Metrics Analysis

The financial health and growth potential of Nvidia and AMD can be evaluated by analyzing key financial metrics, such as revenue, gross margin, operating margin, and net income.

- Nvidia’s revenue growth has been consistently higher than AMD’s, indicating its strong market position and ability to capture a larger share of the market. Nvidia’s revenue growth has been fueled by its dominance in the gaming GPU market and its strong position in the data center and AI markets.

- AMD’s gross margin has shown a significant improvement in recent years, exceeding Nvidia’s gross margin in 2022. This improvement can be attributed to AMD’s focus on optimizing its manufacturing processes and its ability to compete effectively in the high-performance computing market.

- Both companies have experienced a decline in their operating margin in recent quarters, due to factors such as increased competition and supply chain disruptions. However, Nvidia’s operating margin remains higher than AMD’s, reflecting its stronger market position and pricing power.

- Nvidia’s net income has been consistently higher than AMD’s, reflecting its higher revenue and profitability. However, AMD’s net income has shown a significant improvement in recent years, driven by its improved profitability and strong revenue growth.

Market share plays a crucial role in the financial performance of Nvidia and AMD.

- Nvidia’s dominance in the gaming GPU market has allowed it to achieve higher revenue and profitability than AMD.

- AMD’s increasing market share in the data center and AI markets has contributed to its strong revenue growth and improved profitability.

- Both companies are actively investing in research and development to maintain and expand their market share.

- The competition between Nvidia and AMD is likely to intensify in the future, as both companies seek to capture a larger share of the growing high-performance computing market.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions have played a pivotal role in shaping the competitive landscape of the GPU market, with both Nvidia and AMD leveraging these strategies to expand their market share, access new technologies, and strengthen their product portfolios.

The impact of these partnerships and acquisitions can be seen in several key areas:

- Market Share Growth: Acquisitions have allowed both companies to gain access to new markets and technologies, contributing to their overall market share growth. For example, Nvidia’s acquisition of Mellanox Technologies in 2019 significantly boosted its presence in the high-performance computing (HPC) market.

- Technological Advancements: Partnerships and acquisitions have facilitated the exchange of knowledge and resources, leading to advancements in GPU architecture, manufacturing processes, and software development. AMD’s partnership with Samsung for the production of its GPUs has been instrumental in improving its manufacturing capabilities.

- Product Diversification: Acquisitions have enabled both companies to diversify their product portfolios, offering a wider range of products and services to cater to different customer segments. Nvidia’s acquisition of ARM Holdings in 2020 expanded its reach into the mobile and embedded systems market.

Potential Future Partnerships and Acquisitions

Looking ahead, several potential partnerships and acquisitions could shape the future of the GPU market:

- Cloud Computing: Both Nvidia and AMD are likely to pursue partnerships and acquisitions in the cloud computing space, as this market is expected to grow significantly in the coming years. Acquisitions of cloud service providers or specialized cloud computing technology companies could provide them with a stronger foothold in this market.

- Artificial Intelligence (AI): The rapid growth of AI applications is driving demand for powerful GPUs. Both companies could consider acquisitions of AI software and hardware companies to strengthen their AI capabilities and offer comprehensive solutions to AI developers and businesses.

- Metaverse and Virtual Reality (VR): The metaverse and VR are emerging as significant growth areas for GPUs. Acquisitions of companies specializing in VR hardware, software, or content creation could give both companies a competitive edge in this rapidly evolving market.

Last Recap

This comprehensive analysis of Nvidia and AMD’s market share provides valuable insights into the GPU industry, highlighting the key drivers, trends, and challenges shaping the future of this dynamic sector. By understanding the competitive landscape, technological advancements, and customer preferences, industry stakeholders can make informed decisions and navigate the ever-evolving GPU market effectively.

A recent study analyzing the NVIDIA and AMD market share revealed a close competition in the graphics card sector. Interestingly, while analyzing the data, a separate issue arose – the 128gb galaxy note s6 edge listings error – which, although seemingly unrelated, might have implications for the mobile gaming market and the overall demand for high-performance graphics.

The study’s findings ultimately suggest a dynamic landscape with both companies vying for dominance, potentially influenced by factors like this error and its potential impact on user behavior.

Securesion Berita Informatif Terbaru

Securesion Berita Informatif Terbaru